Update: We are now able to submit your biometric data at your first trip without any documentation ready. Please disregard the communication bellow.

We have been receiving investors in Portugal within the past 2 years that are coming without the full set of documents to present to Immigration Department. Due to the changes on internal procedures inside Immigration Department for the following period of time all Investors which decide to travel to Portugal to submit their finger prints and their biometric data need to have their documentation required.

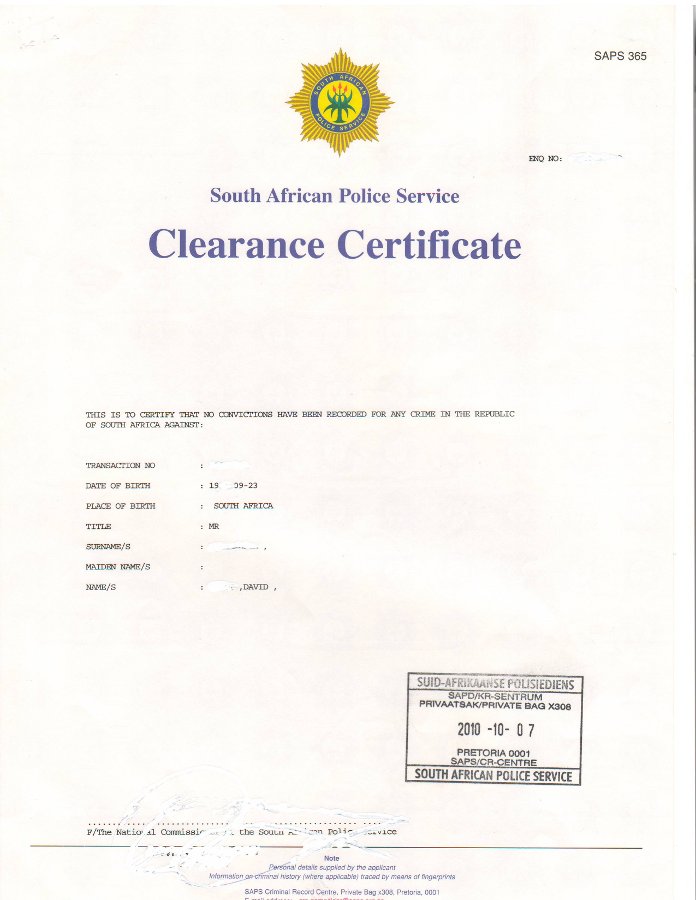

Due to this changes, we are now requesting all Investors to collect their Police Clearance Report duly stamped by Portugal Embassy of their document issuing country before traveling to Portugal. In case you are bringing your family please also collect their Police Clearance Report, Marriage Certificate or Birth Certificate in order to be able to start the process (all documents need to be duly stamped at Portugal Embassy).

Since the demand of the program is increasing quickly it is now requested that Investors advise their travel intentions 4 weeks before their traveling date in order to assure a visit to Immigration Department. In case you are planing to fly in a much shorter period than the one announced here, please contact us in order to identify the risks and possible solutions.

For those who intent to travel without the documents, please be aware that after your investment is completed and your process is been approved you will need to travel to Portugal to submit your biometric data in order to be able to receive your residence permit card.

The Golden Visa Immigration procedures are being revised, for the time being those are the current rules, once the system has been updated we will inform you.